28 September 2020

This update covers:

- New Job Support Scheme.

- Tax deferrals.

- More help for the self-employed.

- More flexibility on loans.

- NHS COVID-19 app launched across England and Wales.

- How to take part in the Kickstart Scheme.

- Rule of six does not affect salons and barbershops.

New Job Support Scheme

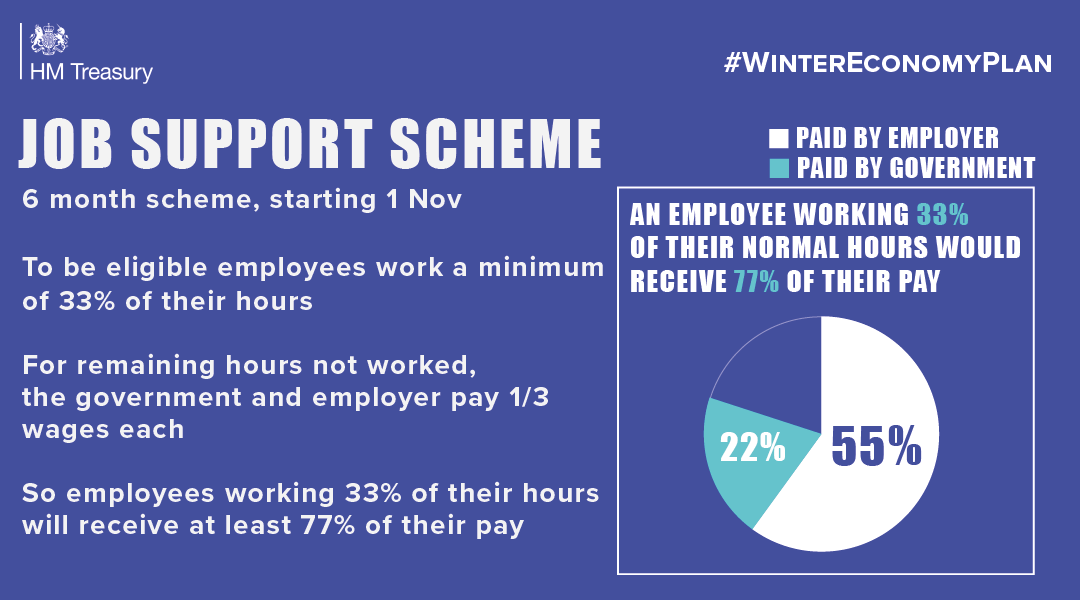

A new Job Support Scheme will be introduced from 1 November 2020 to protect viable jobs in businesses that are facing lower demand over the winter months due to coronavirus. Under the scheme, which will run for six months, the government will contribute towards the wages of employees who are working fewer than normal hours due to decreased demand.

Employers will pay the wages of staff for the hours they work. However, for the hours not worked, the government and the employer will each pay one third of their equivalent salary. Employees must be working at least 33% of their usual hours. The level of grant will be calculated based on the employee’s usual salary, capped at £697.92 per month.

The Job Support Scheme will be open to businesses across the UK even if they have not previously used the furlough scheme. Further guidance about the scheme will be published by the government shortly.

Read the NHBF’s response to the new scheme.

Deferring tax payments

Salons and barbershops who deferred their VAT bills will be given the option to pay back in smaller instalments.

Self Assessment taxpayers can also benefit from a separate additional 12-month extension from HMRC on the “Time to Pay” self-service facility, meaning payments deferred from July 2020, and those due in January 2021, will now not need to be paid until January 2022.

More help for the self-employed

The grant scheme for the self-employed has been extended. The extension will provide two taxable grants, each covering three months from November 2020 to April 2021. The first grant will cover 20% of average monthly trading profits capped at a total of £1,875. The level of the second grant for February to April 2021 will be decided in due course. Find out more on the government website.

More flexibility on loans

Businesses who took out a Bounce Back Loan will be given the option to repay their loan over a period of up to ten years through a new ‘Pay as You Grow’ flexible repayment system. Interest-only periods of up to six months and payment holidays will also be available to businesses.

Coronavirus Business Interruption Loan Scheme lenders will be able to extend the length of loans from a maximum of six years to ten years if it will help businesses to repay the loan.

The government is extending four temporary loan schemes to 30 November 2020 for new applications: the Business Interruption Loan Scheme; the Coronavirus Large Business Interruption Loan Scheme; the Bounce Back Loan Scheme; and the Future Fund.

NHS COVID-19 app launched across England and Wales

The government is encouraging everyone in England and Wales to download the recently launched COVID-19 app. Find out more on the government website.

From today, people across England will be required by law to self-isolate if they test positive or are contacted by NHS Test and Trace. Those breaking the rules will be fined up to a maximum of £10,000 for repeat offenders.

How to take part in the Kickstart Scheme

The Kickstart Scheme is a £2bn initiative to help young people claiming Universal Credit move into the world of work. If you would like your salon or barbershop to take part, but have fewer than the 30 work placements required, you can work with a gateway organisation who will apply on your behalf. Find out more.

England: ‘rule of six’ does not affect salons and barbershops

In England, social gatherings of more than six people indoors or outdoors are against the law. This applies to social gatherings only and does not affect salons and barbershops.

- Read our four nations FAQs.

- Read our FAQs on the government’s safe reopening guidelines.

- Download our free reopening guide for salons and barbershops. Non-members will need to create a free account.

- Our coronavirus FAQs are regularly updated. Check back often for the latest information.Read our regularly updated job retention scheme FAQs.

- NHBF Members can download an information poster, email and social media message for clients.

- Members can call our membership team, Monday-Friday, 9-5, on 01234 831965. Please be patient due to the extremely high level of calls we are currently getting.

- For legal advice, Members can login to get our 24/7 legal helpline number. Again, please be patient. The legal team is also dealing with a huge number of calls.